Mr. White has Medicare Parts A and B, providing him with essential health insurance coverage. Medicare Part A covers hospital stays, while Part B covers medical services such as doctor visits and outpatient care. Understanding the benefits and limitations of these parts is crucial for Mr.

White to optimize his healthcare experience.

This comprehensive guide will delve into the specific coverage provided by Medicare Parts A and B, addressing their impact on Mr. White’s healthcare expenses. We will also explore coverage gaps and limitations, as well as alternative coverage options to ensure Mr.

White receives the best possible care.

Medicare Parts A and B

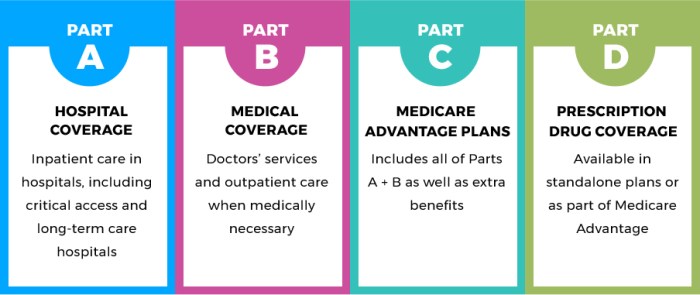

Medicare Parts A and B are two essential components of the Medicare health insurance program. Together, they provide comprehensive coverage for hospital, medical, and related healthcare services.

Medicare Part A Coverage

- Hospital stays

- Skilled nursing facility care

- Home health care

- Hospice care

Medicare Part B Coverage, Mr. white has medicare parts a and b

- Doctor visits

- Outpatient services

- Preventive care

- Durable medical equipment

Mr. White’s Coverage

Mr. White has Medicare Parts A and B, which provide him with the following benefits:

Medicare Part A Benefits

- Coverage for a hospital stay of up to 90 days

- Coverage for skilled nursing facility care for up to 100 days

- Coverage for home health care for up to 100 visits per year

Medicare Part B Benefits

- Coverage for doctor visits, including primary care and specialist visits

- Coverage for outpatient services, such as X-rays, laboratory tests, and physical therapy

- Coverage for preventive care, including flu shots and cancer screenings

Coverage Gaps and Limitations

While Medicare Parts A and B provide comprehensive coverage, they also have some limitations:

Medicare Part A Limitations

- Does not cover long-term care

- Has a lifetime limit on skilled nursing facility care

- May require a copayment or coinsurance for certain services

Medicare Part B Limitations

- Does not cover prescription drugs

- May require a deductible and coinsurance for certain services

- Does not cover all medical services, such as dental and vision care

To fill coverage gaps, Mr. White can consider purchasing Medigap or Medicare Advantage.

Cost Considerations: Mr. White Has Medicare Parts A And B

The monthly premiums for Medicare Parts A and B vary depending on income and other factors.

For Mr. White, the estimated monthly premiums are:

- Part A: $0 (due to paying into Medicare for 10 years or more)

- Part B: $164.90

Mr. White’s out-of-pocket expenses under his current coverage may include:

- Copayments for doctor visits and outpatient services

- Coinsurance for hospital stays and skilled nursing facility care

- Deductible for Part B services

Alternative Coverage Options

Mr. White can explore other health insurance options besides Medicare Parts A and B, such as:

- Medigap: Provides additional coverage to fill gaps in Medicare coverage

- Medicare Advantage: Combines Parts A and B coverage into a single plan

- Private health insurance: May provide more comprehensive coverage but typically at a higher cost

Mr. White should carefully consider his healthcare needs, budget, and preferences when selecting the most suitable coverage option.

Top FAQs

What specific benefits does Mr. White receive under Medicare Part A?

Medicare Part A covers hospital stays, including room and board, nursing care, and other related services.

How do Medicare Parts A and B impact Mr. White’s healthcare expenses?

Medicare Parts A and B help reduce Mr. White’s healthcare expenses by covering a significant portion of his hospital and medical costs, reducing his out-of-pocket expenses.

What options are available to fill coverage gaps in Medicare Parts A and B?

Options to fill coverage gaps include Medigap policies, which supplement Original Medicare, or Medicare Advantage plans, which offer comprehensive coverage in a single plan.