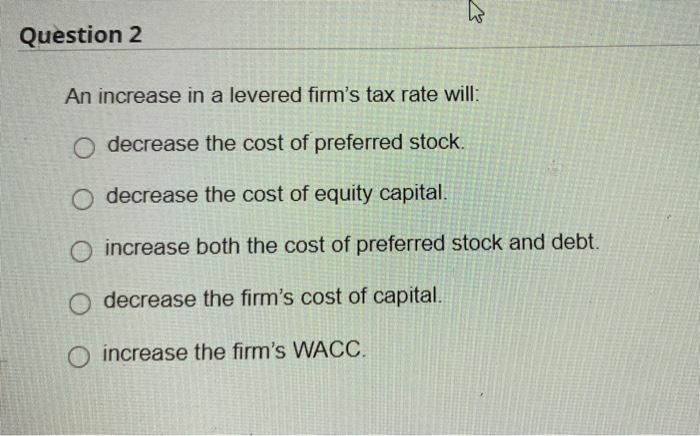

An increase in a levered firm’s tax rate will have significant financial, market, and strategic implications. This comprehensive analysis delves into the impact on earnings per share, debt-to-equity ratio, and overall financial stability, examining market reactions, historical examples, and strategic options available to affected firms.

Industries particularly sensitive to tax rate changes are identified, highlighting potential implications for their future performance.

Financial Impact

An increase in a levered firm’s tax rate has significant financial implications. Firstly, it directly reduces the firm’s earnings per share (EPS). As taxes represent a deductible expense, a higher tax rate means a lower after-tax profit, leading to a lower EPS.

Secondly, a tax rate increase can affect the firm’s debt-to-equity ratio. If the firm chooses to absorb the tax burden without passing it on to customers or suppliers, it will need to pay higher taxes from its cash flow. This can lead to a decrease in available cash and an increase in debt relative to equity, potentially raising the firm’s overall risk profile.

Finally, a tax rate increase can impact the firm’s overall financial stability. If the firm is unable to absorb the tax increase, it may need to raise capital to meet its tax obligations. This can be expensive and dilute the equity holders’ ownership, potentially destabilizing the firm’s financial position.

Market Reaction: An Increase In A Levered Firm’s Tax Rate Will

The market typically reacts negatively to news of an increase in a levered firm’s tax rate. Investors perceive it as a reduction in the firm’s profitability and a potential increase in its risk profile. This negative sentiment can lead to a decline in the firm’s stock price.

However, the market reaction can vary depending on the industry and the firm’s specific circumstances. For example, firms in highly regulated industries may have less flexibility in passing on tax increases to customers, making them more vulnerable to negative market reactions.

Conversely, firms with strong market positions and pricing power may be able to absorb the tax increase without significantly impacting their profitability, leading to a more muted market reaction.

Strategic Implications

A levered firm facing an increase in its tax rate has several strategic options available:

| Strategy | Pros | Cons |

|---|---|---|

| Debt Restructuring | Reduces interest expenses and improves cash flow | May increase refinancing risk and reduce financial flexibility |

| Equity Issuance | Raises capital to meet tax obligations and reduce leverage | Dilutes equity ownership and increases cost of capital |

| Operational Efficiency Improvements | Reduces operating costs and improves profitability | Can be difficult to implement and may take time to show results |

Industry Analysis

Certain industries are particularly sensitive to changes in tax rates:

- Utilities:Utilities are often regulated and have limited ability to pass on tax increases to customers.

- Financial Services:Financial institutions are heavily taxed and face significant regulatory compliance costs.

- Real Estate:Real estate firms rely on tax deductions for depreciation and interest expenses.

In the past, tax rate changes have significantly impacted firms in these industries. For example, the Tax Cuts and Jobs Act of 2017 in the United States led to a decrease in tax rates for many corporations, resulting in increased profitability and stock price appreciation for firms in these sectors.

Answers to Common Questions

How does an increase in tax rate affect a levered firm’s earnings per share?

Tax rate increases reduce earnings per share by lowering the firm’s after-tax income.

What are the strategic options available to a levered firm facing an increase in its tax rate?

Strategic options include debt restructuring, equity issuance, and operational efficiency improvements, each with its own pros and cons.